Retirement Guidance &

Planning Professionals

Think Differently, Retire Happily by learning and applying these 7 keys in Your Plan.

- More Confidence

- Greater Efficiency

- Predictable Results

Money in Retirement is Important AND There is So Much More!

Get better than one might expect and avoid regret.

Have a holistic plan for your specific situation.

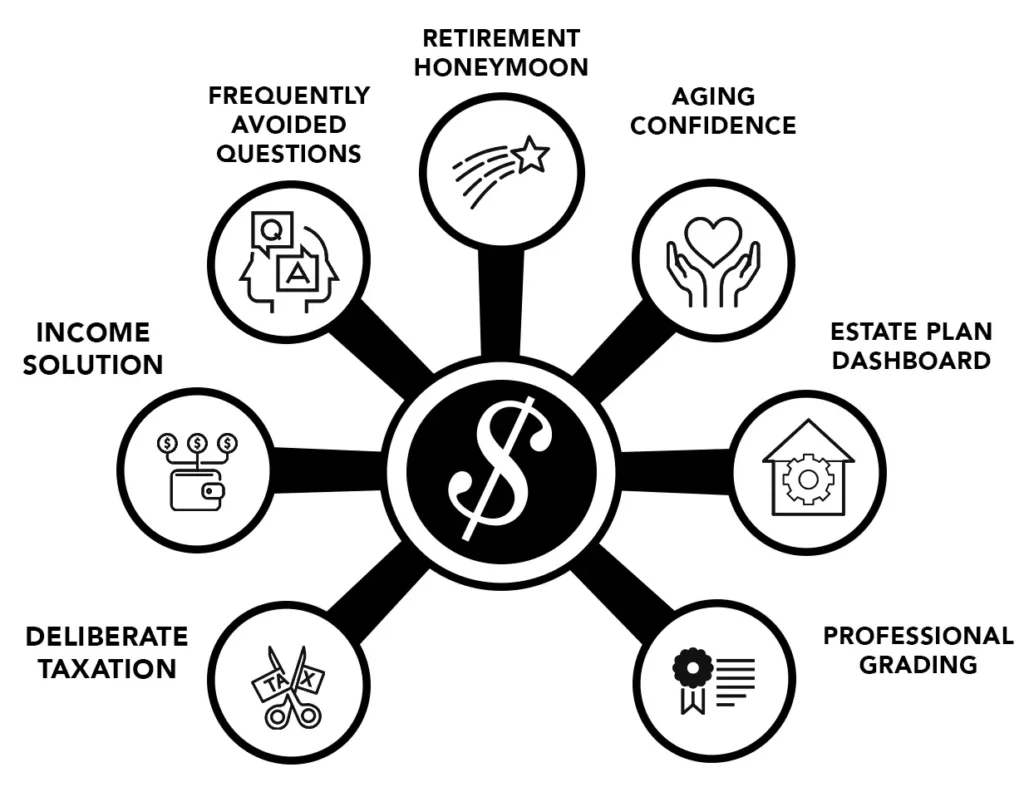

Write Your Story with Our 7 Keys to Retire Happily

Retirement Honeymoon: Commencement

What is retirement the beginning of for you?

How will you know you are on a path where 5 or 35 years from now you will assess yourself as having ‘Retired Happily’?

Retiring Happily Includes Three Key Components:

A Purpose-Driven Lifestyle

Embracing experiences that bring meaning, joy, and fulfillmen.

A Predictable Financial Strategy

Ensuring security, tax efficiency, and asset transformation process.

Monitor & Measure

Report card to assess & plan to make adjustments.

Retiring Happily includes three key components:

✅ A purpose-driven lifestyle: Embracing experiences that bring meaning, joy, and fulfilment.

✅ A predictable financial strategy: Ensuring security, tax efficiency, and asset

✅ Monitor & Measure: Report card to assess & plan to make adjustments.

Retiring Happily includes two key components:

✅ A purpose-driven lifestyle: Embracing experiences that bring meaning, joy, and fulfilment.

✅ A predictable financial strategy: Ensuring security, tax efficiency, and asset

✅ Monitor & Measure: Report card to assess & plan to make adjustments.

Are you ready for a retirement that feels as rewarding as you fantasized in the years building your wealth?

Many retirees with healthy savings struggle to shift from accumulation to confident enjoyment. The fear of using too much and running out, tax inefficiencies, and market forces lead to regret rather than freedom.

But, you know what, it doesn’t have to be that way.

Breaking Free from the Saver’s Addiction

Many high-net-worth individuals spend a lifetime focused on saving, but that same mindset can make it difficult to spend with confidence in retirement. The Retirement Honeymoon is about shifting your perspective—giving yourself permission to enjoy the wealth you’ve built while still being financially wise.

From Sacrifice to Significance

Money isn’t just for security — it’s a tool for creating a life you love. Whether it’s travel, hobbies, philanthropy, or new experiences, the key is strategically positioning your assets to fund these goals predictably and efficiently.

What’s Next?

✔️ Are your assets structured to provide reliable income without unnecessary tax erosion?

✔️ Do you have a framework that allows you to use your money without fear?

✔️ Are you prepared for the unexpected — both financially and personally?

It’s time to rethink retirement. Your best years are ahead — let’s make them count.

📥 Download the “Retirement Honeymoon” Checklist & Start Planning Today!

Are you ready for a retirement that feels as rewarding as you fantasized in the years building your wealth?

Many retirees with healthy savings struggle to shift from accumulation to confident enjoyment. The fear of using too much and running out, tax inefficiencies, and market forces lead to regret rather than freedom.

But, you know what, it doesn’t have to be that way.

Breaking Free from the Saver’s Addiction

Many high-net-worth individuals spend a lifetime focused on saving, but that same mindset can make it difficult to spend with confidence in retirement. The Retirement Honeymoon is about shifting your perspective—giving yourself permission to enjoy the wealth you’ve built while still being financially wise.

From Sacrifice to Significance

Money isn’t just for security — it’s a tool for creating a life you love. Whether it’s travel, hobbies, philanthropy, or new experiences, the key is strategically positioning your assets to fund these goals predictably and efficiently.

What’s Next?

✔️ Are your assets structured to provide reliable income without unnecessary tax erosion?

✔️ Do you have a framework that allows you to use your money without fear?

✔️ Are you prepared for the unexpected — both financially and personally?

It’s time to rethink retirement. Your best years are ahead — let’s make them count.

📥 Download the “Retirement Honeymoon” Checklist & Start Planning Today!

Frequently AVOIDED Questions

What questions should I be asking?

What questions do my older peers wish they would have asked at this phase?

We will get into the top 20 questions your peers wish they would’ve asked, but before we do that, here is a simple acronym guide:

The ACE Plan: A Prudent Approach to Retirement Decisions

✅ A – Adapt & Adjust — how is this giving me more flexibility in age?

✅ C – Control / Freedom — how is this giving me more control or freedom?

✅ E – Exit Strategy — when I’m ready to make a change, how and how much will it cost?

What do my peers wish they would have asked at my stage?

👉 Check out CFP advisor AI assistant

Retirement planning isn’t just about accumulating wealth — it’s about making strategic decisions that give you flexibility, control, and transition options. The ACE Plan helps retirees like you navigate financial choices with confidence, ensuring you can adapt and adjust, maintain control and freedom, and plan your exit strategy for every major financial decision.

A Holistic Approach to Retirement Security

The ACE Plan helps you build a resilient financial foundation, from income and tax strategies to estate planning, ensuring you can live with confidence and purpose in retirement.

With the right approach, you can retire with confidence, knowing your financial future is secure — no matter what life brings.

🔁 Adapt & Adjust

Life is unpredictable, and your financial plan should be able to adjust to unforeseen events — whether it’s market changes, family needs, or health concerns. Ask yourself: Does this decision give me the flexibility to pivot if life takes an unexpected turn?

🛠️ Control & Freedom

Your financial choices should empower you, not restrict you. A well-structured estate, tax, and income plan ensures control over your assets and freedom to enjoy your wealth without fear. How does this choice enhance my financial security and peace of mind?

🚪 Exit Strategy

Every decision should have a well-defined exit plan. If your circumstances change or a financial tool no longer serves you, what’s the process to adjust or withdraw, and what will it cost?

The 4-Category Retirement Income Strategy

How to Create a Sustainable Retirement Income Plan

To build a sustainable income plan, categorize your expenses:

✅ Needs – Essentials like housing, utilities, food, and transportation. These should be covered by guaranteed income sources.

✅ Wants – Travel, self care, dining out, hobbies — these enhance your retirement. Prioritize reliable income streams and allow for flexibility.

✅ Novelties – One-time or extra expenses, like a dream vacation, home renovation, or fun car. These funds can be drawn from moderately predictable investments.

✅ Discretionary Income – Extra savings for unexpected opportunities or risk-adjusted investments. Not likely essential, and useful for long-term flexibility.

Why This Works

By securing predictable income for your needs and wants, you reduce the stress of market fluctuations and avoid relying on uncertain investment returns. Inflation matters, but not indefinitely — many expenses naturally decrease with age, making long-term projections more manageable.

Maximizing Social Security & Avoiding Negativity Bias

Media often stirs fear about retirement shortfalls, but strategic planning eliminates unnecessary worry. Social Security plays a role, but when to claim it depends on your unique situation. Consulting a knowledgeable advisor ensures you make the right decision.

Retirement planning doesn’t have to be stressful. By structuring your income sources around these categories, you can retire with confidence and financial security.

Retirement shouldn’t feel like a financial guessing game. The key to peace of mind is predictable, reliable income that aligns with your lifestyle. Instead of fixating on a daunting “retirement number,” take a smarter, structured approach to income planning.

Save on Tax — Be Deliberate

✅ Know Your Tax Bracket — If you’re close to the top of your bracket, delay withdrawals or take money from tax-free accounts to avoid higher taxes.

✅ Evaluate Alternatives to Roth Conversions — Cleansing IRA tax to create tax-free multiplied value.

✅ Diversify Your Tax Buckets — Strategically position tax-deferred, taxable, and tax-free accounts to optimize withdrawal benefit and cost.

✅ Leverage Qualified Distributions — Directly from your IRA to reduce taxable income.

Most retirees overpay in taxes simply because they treat tax season as a history lesson — learning what they owe after it’s too late to make adjustments. Instead, take control and pay taxes deliberately with proactive planning.

The Key to Tax Savings: Consistency & Awareness

To reduce tax costs over time, focus on keeping your taxable income stable year to year. Avoid sudden spikes that push you into higher tax brackets, like withdrawing large sums from a 401(k) without a plan. Before December 31st each year, review your tax bracket and make strategic moves to minimize unnecessary taxes.

Avoid Costly Mistakes

Taking large lump sums from tax-deferred accounts — like one retiree who withdrew $90,000 to pay off debt — can trigger unexpected tax bills. Instead, spread withdrawals over multiple years to manage tax impact.

Take Control Before Year-End

Each Thanksgiving, meet with your tax preparer to project your taxable income. Proactive tax planning can save you thousands over your retirement. Write your own tax story — don’t let the IRS write it for you!

Aging Confidently – Smart Financial Protection as You Age

Biggest fear — more than stock market loss or rising taxes — is not aging well.

It doesn’t have to be that way.

✅ Transform assets to support aging challenges as needed

✅ Create tax-free multiplied value for yourself and your family

✅ Give yourself more options, flexibility, and protection as you age

✅ Know your long-term care options — Traditional policies have rising costs, but new alternatives offer guaranteed benefits without premium increases

Retirement planning is an ongoing event. It isn’t a “set it and forget it” process. As your needs change, your financial plan — including life insurance and long-term care — should evolve too. Regular financial audits with your advisor help ensure your strategy still aligns with your goals and protects your future.

Why You Need a Life Insurance Audit

Many retirees assume their life insurance policy will last forever, but outdated mortality tables can cause cash value to decline unexpectedly. Without regular reviews, you could face rising premiums or a policy that expires too soon. A simple in-force illustration can reveal how long your policy will last and whether adjustments are needed.

Secure Tax-Free Benefits & Peace of Mind

Aging doesn’t have to mean financial uncertainty. By proactively managing your life insurance and care planning, you can protect yourself and your family from unnecessary stress and expenses. Meet with your advisor regularly to stay in control of your financial future.

Estate Plan Dashboard

Estate planning isn’t just about wealth — it’s about ensuring you are tended to, your wishes are honored, your loved ones are protected, and your assets are distributed efficiently. Without a clear plan, the courts may be involved in what happens to your estate.

Key Aspects of Estate Planning

✅ Choose Who Helps You as You Age — A durable power of attorney and healthcare power of attorney ensure trusted individuals can make financial and medical decisions on your behalf.

✅ Control Where Your Assets Go — Ensure your belongings are distributed according to your wishes, preventing legal battles and unnecessary costs.

✅ Avoid Probate & Unnecessary Taxes — Proper planning keeps your estate out of court, minimizes taxes, and speeds up the transfer of assets to your heirs.

✅ Simplify Inheritance for Loved Ones — Clearly designate beneficiaries and outline sentimental possessions to prevent family disputes.

Why Act Now?

Waiting until a health issue arises may be too late. Updating your estate plan every five years ensures it reflects your current situation. Without a plan, the government — not your family — decides your future.

Estate planning is about more than legal documents — it’s about preserving your legacy, protecting your assets, and giving your family peace of mind. Start today to ensure you remain in control.

📌 Download ‘Estate Planning Basics’ E-Book or Videos explaining what you need to know.

Professional Grading

Performance Reviews are Key

The right financial advisor, tax preparer, and estate-planning attorney are essential to securing your retirement and protecting your wealth. While recommendations from friends and family are helpful, the right professional for them may not be the best fit for you.

Just as the medical field has evolved into specialized areas, financial services have become more complex, requiring specialists who understand the intricacies of navigating retirement, taxes, and estate management. 🧠💼 It’s not fair to expect one professional to be an expert in everything, making it crucial to assemble a team of professionals who align with your unique needs and goals.

Key Questions to Ask When Choosing a Professional

To ensure you’re working with the right experts, ask these essential questions when interviewing financial professionals:

✅ Financial Advisors — What makes you a fiduciary? What is your investment philosophy? What is your process to tailor strategies to my situation?

✅ Tax Preparers — How do you prevent unnecessary tax costs? What is your process for projecting and strategically minimizing tax? What are your resources to specialize in retirement tax reduction?

✅ Estate-Planning Attorneys — Do you focus solely on estate planning? How often are you in court probating or processing an estate? How do you collaborate with other financial professionals?

The Right Team for a Confident Retirement

Building a financial team with specialists who understand your unique needs ensures your retirement strategy is secure and effective. Thoughtful planning with the right professionals gives you the freedom to retire confidently, knowing your financial future is in expert hands.

📌 Ready to find the right professionals for you? Download our checklist and interview guide at RetireHappily.net/professionals.

You are Experiencing a Process in Our 3rd Decade of Serving Retirees.

As we continue to fine-tune your experience to discuss these very personal and difficult topics, we ask for your thoughts and feedback.

5-Star Reviews

After each meeting, you are asked:

⭐️⭐️⭐️⭐️⭐️ We Listened Well

⭐️⭐️⭐️⭐️⭐️ You Felt Understood

⭐️⭐️⭐️⭐️⭐️ You Felt Honored

How can we better serve others?

Trusted Retirement Publications

Results

“

“Yes, I want to know that I am ‘all set’. I appreciate your insights. They have given me answers to questions I would not have known to ask and may have been too embarrassed to do so. I appreciate the story of the corporate finance executive with the pedigree of degrees who was forthright with you about the things he didn’t know.

Personal finance is so much different than corporate. We are grateful for your encouraging and empathic approach when discussing our past and current challenges. My wife says it is nice to feel we have an advocate for our success in retirement.”

“

Retired CFO, Fortune 100 Company

Free Resource - Estate Planning Basics

Fill Out The Form To Access This eBook

Real Results – Case Studies

Get Better than One Might Expect and Avoid Regret

Here are 10 concise case studies demonstrating how your **7 Keys** were applied to help retirees aged 64–84 with $500,000 to $2,500,000 in savings. These examples highlight how they addressed aging challenges, achieved income security, gained peace of mind, and expressed gratitude for your thoughtful feedback process.

Paul and Sandra, 65 and 64, with $1.2M in savings.

Challenge – Important to find purpose in retirement.

Navigated “Retirement Honeymoon” plan, incorporating travel, volunteering, and personal growth goals.

Comment – We rediscovered meaning and joy in retirement, appreciating your ability to listen well to our aspirations while aligning our assets to meet our needs and desires.

Sarah, 70, widow with $850,000.

Challenge – Worried about running out of money and avoiding family conflicts over inheritance.

Addressed fears openly, clarified her financial situation, put a protection plan in place for her aging concerns and established a detailed estate plan to reduce family disputes.

Comment – I felt understood and relieved to have a solid plan not based on statistics. Thank you for your direct approach.

Mike, 67, with $900,000 in cash-heavy accounts and a healthy pension.

Challenge – Low returns, concerns about inflation and taxes.

Shifted his cash to a diversified portfolio including a life insurance based savings account to manage aging challenges, inflation, and income taxes.

Comment – I was impressed by your explanation of how my money could work for me with a diverse plan. I felt honored as you helped me get my savings set up for me and still give me the security I prefer.

What is Retire Happily?

We believe today’s saver deserves much more! Improper alignment of financial tools with your needs and preferences is the major source of missed opportunity, disappointment and regret. And you know what? It doesn’t have to be that way!