Why is this important?

Bonds don’t work the way they used to. You may lose money in your bond fund just because interest rates rise.

Find out how this affects you.

Get answers to all these questions;

- How can my bond fund go down in value when interest rates rise?

- What should I be asking to know more about my bond funds?

- Are there any alternatives to bonds that I should be considering?

For over three decades, we have been able to depend on bonds for fixed income. And, as interest rates have trickled down for over thirty years, when we sold a bond prematurely or held a bond fund, we got a bonus in value as interest rates declined.

Added benefit of interest rates lowering

If you bought a ten-year bond at 7%, you might decide to sell it before the ten years are over. If in the meantime, interest rates for that same bond went down to 6%. Not only will you earn 7% annually on the bond you bought, but when you sell it, you will be able to get a bonus on your original investment calculated by the remaining duration of the initial ten year bond. In this example, if you invested $100,000 in a bond paying 7% per year, each year, you would receive 7% interest on the bond. If over the next two years, interest rates go down and the new bonds are paying 6%, and you sold your bond, the bonus you would receive is an additional 8%. The 8% comes from the extra 1% per year interest you are earning on your 7% bond multiplied by the remaining eight years, which equals 8%.

Put another, your total gains over 2 years on your $100,000 investment would be 22% or 11% per year. 7% + 7% +8% = 22%

Penalty of interest rates rising

Conversely, if you bought a ten-year bond at 6%, and decided to sell it before the ten years is over. If in the meantime, interest rates for that same bond went up to 7%. Not only will you earn the 6% annually on the bond you bought, but when you sell it, you will get a penalty on your original investment calculated by the remaining duration of the original ten-year bond. In this example, if you invested $100,000 in a bond paying 6% per year, each year, you would receive 6% interest on the bond. If over the next two years, interest rates go up and the new bonds are paying 7%, and you sold your bond, the penalty is an additional 8%. The 8% comes from the extra 1% per year interest; the new bonds are earning over your 6% bond multiplied by the remaining eight years, which equals 8%.

Put another, your total gains over 2 years on your $100,000 investment would be 4% or 2% per year. 6% + 6% -8% = 4%

What you need to know…

How can my bond fund go down in value when interest rates rise?

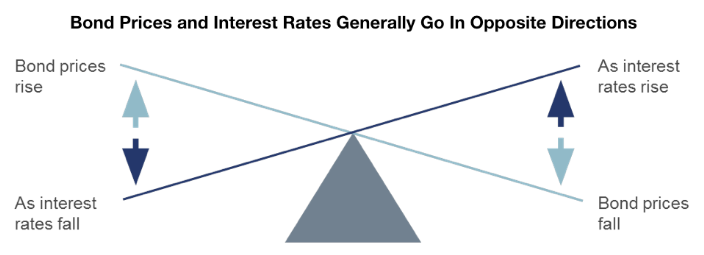

WARNING: The value of your bonds go down when interest rates rise.

As shown above, when interest rates rise, the value of your bond or bond fund mathematically must go down in value. With bond funds, this is called ‘mark to market’ and it happens every day at 4 pm EST when the stock market closes.

What should I be asking to know more about my bond funds?

Many are taught to ask what the morning star rating of the bond fund is, but that can be misleading. The questions that will give you the best information on how sensitive your bonds or bond funds are to interest rate risk is;

What is the average duration of the bonds in my portfolio?

The longer the duration, the more sensitive they are.

What is the average credit rating of the bonds in my portfolio?

The lower the credit rating, the more sensitive they are.

Are there any alternatives to bonds that I should be considering?

Yes, in fact, as you will see in the Next Topic, we discuss the importance of Exit Strategy, Control, and ability to Adapt and Adjust over time. There are a few alternatives that can give you predictable income without the interest rate risk of bonds.